Welcome to the definitive guide on “Unlocking Financial Success: Your Guide to Effective Finance and Wealth Management.” In today’s dynamic economic landscape, navigating the path to financial prosperity requires more than just basic money management skills. This comprehensive article delves deep into the intricacies of finance and wealth management, providing actionable insights and strategies to help you optimize your financial journey. Whether you’re a seasoned investor or just starting out, discover how to leverage the power of finance and wealth management to secure your financial future.

Embark on a transformative journey towards financial empowerment with our comprehensive guide to “Unlocking Financial Success: Your Guide to Effective Finance and Wealth Management.” In an era where financial literacy is paramount, understanding the nuances of finance and wealth management is key to achieving your monetary goals. This article serves as your roadmap, offering expert advice and practical tips tailored to help you navigate the complexities of the financial world. Learn how to harness the principles of finance and wealth management to build a solid foundation for lasting prosperity.

Dive into the realm of financial abundance with our in-depth exploration of “Unlocking Financial Success: Your Guide to Effective Finance and Wealth Management.” As the cornerstone of personal and professional fulfillment, mastering finance and wealth management is essential for realizing your aspirations. This authoritative guide provides a comprehensive overview of the fundamental concepts and best practices in finance and wealth management, equipping you with the knowledge and tools needed to make informed financial decisions. Whether you’re striving for financial independence or aiming to grow your wealth, unlock the secrets to success in finance and wealth management with this indispensable resource.

Table of Contents

Foundations of Finance – Finance and Wealth Management

Understanding the Foundations of Finance offers multifaceted benefits within the realm of wealth management. Firstly, it cultivates a deep comprehension of financial principles essential for making informed decisions. By grasping concepts such as compounding interest, asset allocation, and risk management, individuals gain the insight needed to optimize their financial strategies. This knowledge empowers them to navigate various investment opportunities wisely, ensuring their wealth grows steadily over time while mitigating potential risks. In essence, a solid understanding of financial fundamentals lays the groundwork for building a robust and resilient financial portfolio, a cornerstone of effective wealth management.

Secondly, mastering the Foundations of Finance fosters financial resilience and adaptability in the face of economic uncertainties. In today’s volatile markets, being equipped with the knowledge to weather financial storms is invaluable. Individuals who understand the principles of finance are better prepared to anticipate market fluctuations, adjust their investment strategies accordingly, and safeguard their wealth against unforeseen risks. This adaptability is crucial for maintaining financial stability and achieving long-term prosperity, even in challenging economic conditions. Thus, the Foundations of Finance serve as a shield, protecting individuals’ wealth and ensuring its continued growth amidst changing financial landscapes.

Furthermore, a solid grasp of financial fundamentals enhances individuals’ confidence in their financial decision-making abilities. When armed with knowledge, individuals are less susceptible to making hasty or ill-informed financial choices. Instead, they can approach financial matters with clarity and conviction, confident in their ability to assess risks, evaluate opportunities, and make sound investment decisions. This confidence not only fosters financial success but also instills a sense of empowerment and control over one’s financial future. Ultimately, by laying a strong foundation in finance, individuals can unlock the full potential of wealth management, realizing their financial goals and aspirations with confidence and clarity.

Basic Principles of Finance

Delving into the Basic Principles of Finance provides a crucial framework for effective wealth management. At its core, these principles serve as guiding principles for individuals seeking to optimize their financial decisions and maximize their wealth. From the concept of opportunity cost to the importance of diversification, these principles offer invaluable insights into how money works and how it can be leveraged to achieve financial goals. By understanding these fundamental principles, individuals can make more informed choices regarding saving, investing, and managing their finances, thus setting themselves on a path towards long-term financial success within the realm of finance and wealth management.

One of the fundamental principles of finance is the concept of risk and return trade-off. This principle underscores the relationship between risk and potential reward in investment decisions. In essence, investments with higher potential returns typically come with higher levels of risk, while investments with lower risk often yield lower returns. Understanding this principle is essential for individuals navigating the complexities of wealth management, as it enables them to strike a balance between risk and reward that aligns with their financial goals and risk tolerance. By applying this principle effectively, individuals can construct investment portfolios that optimize returns while mitigating risk, thereby enhancing their overall financial well-being in the realm of finance and wealth management.

Importance of Financial Literacy

The Importance of Financial Literacy cannot be overstated in the context of finance and wealth management. Financial literacy encompasses the knowledge and skills necessary to understand and manage one’s finances effectively. It equips individuals with the ability to make informed financial decisions, budget effectively, manage debt responsibly, and plan for the future. Within the realm of finance and wealth management, financial literacy serves as a cornerstone for building a strong financial foundation. By educating themselves on topics such as budgeting, investing, taxes, and retirement planning, individuals can take control of their financial destinies and work towards achieving their long-term financial goals with confidence and clarity.

Moreover, financial literacy empowers individuals to navigate the complexities of the modern financial landscape with confidence. In today’s interconnected world, financial decisions have far-reaching implications, and being financially literate enables individuals to understand the potential consequences of their choices. Whether it’s deciphering complex financial products, evaluating investment opportunities, or planning for retirement, a solid understanding of financial concepts allows individuals to make sound decisions that align with their financial goals and values. By promoting financial literacy, individuals can unlock the full potential of finance and wealth management, paving the way for financial stability, security, and prosperity now and in the future.

Setting Financial Goals

Setting Financial Goals is a crucial step in the journey towards effective finance and wealth management. These goals serve as the guiding force behind all financial decisions, providing individuals with a clear sense of purpose and direction. Whether it’s saving for retirement, purchasing a home, or funding a child’s education, defining specific, measurable, achievable, relevant, and time-bound (SMART) financial goals is essential for success. By establishing concrete objectives, individuals can create a roadmap that outlines the steps needed to achieve their desired financial outcomes within the realm of finance and wealth management.

Furthermore, setting financial goals enables individuals to prioritize their spending and savings habits, ensuring that their resources are allocated efficiently towards their most important objectives. This process encourages discipline and accountability, as individuals are motivated to make conscious choices that align with their long-term financial aspirations. Additionally, regularly reviewing and revising financial goals allows individuals to adapt to changing circumstances and stay on track towards financial success. Ultimately, by setting clear and attainable financial goals, individuals can harness the power of finance and wealth management to turn their dreams into reality and secure a prosperous future for themselves and their loved ones.

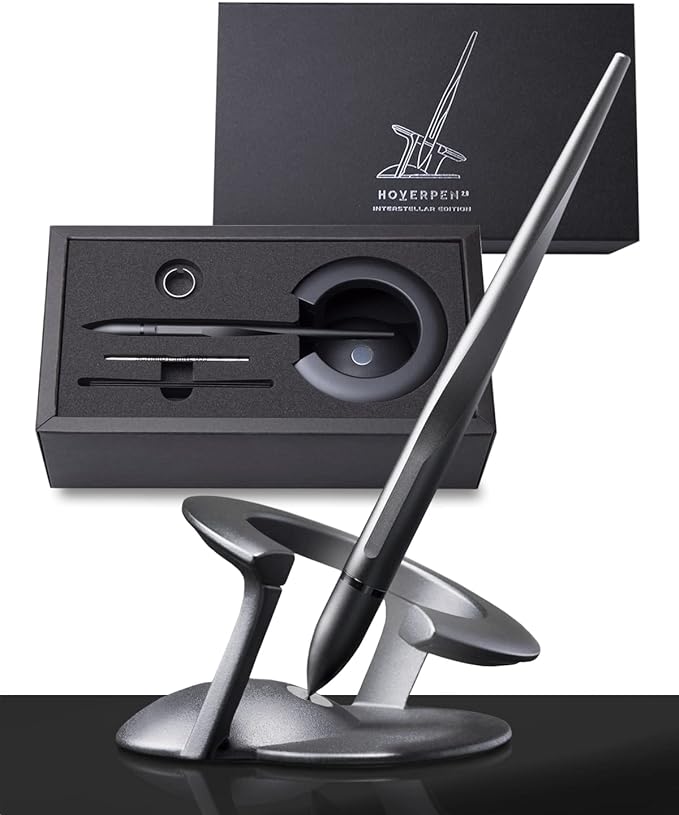

Space Black, Ballpoint Pen, Unique Conversational Starter, Premium Futuristic Design, Precision Flow Ink, Schmidt Ballpoint Cartridges

- Brand novium

- Writing Instrument Form Ballpoint Pen

- Color Space Black

- Ink Color Black

- Age Range (Description) Adult

Wealth Management Fundamentals

Wealth Management Fundamentals represent the cornerstone of effective financial planning within the broader context of finance and wealth management. At its core, wealth management encompasses a holistic approach to managing an individual’s finances, encompassing investment planning, retirement planning, tax optimization, estate planning, and more. Understanding the fundamentals of wealth management is essential for individuals seeking to build and preserve their wealth over the long term. It involves a comprehensive assessment of an individual’s financial situation, goals, and risk tolerance to develop tailored strategies that align with their unique circumstances and aspirations. By mastering these fundamentals, individuals can lay the groundwork for a secure financial future and achieve their desired outcomes.

One key aspect of Wealth Management Fundamentals is asset allocation, which involves strategically diversifying investments across different asset classes to optimize returns while minimizing risk. This principle recognizes that different asset classes, such as stocks, bonds, real estate, and commodities, have varying levels of risk and return potential. By allocating assets based on factors such as risk tolerance, time horizon, and investment objectives, individuals can construct a well-balanced portfolio that maximizes returns while mitigating volatility. Asset allocation is a fundamental concept in wealth management, as it forms the basis for building a resilient investment strategy that can withstand market fluctuations and achieve long-term financial goals within the realm of finance and wealth management.

Additionally, Wealth Management Fundamentals encompass the importance of ongoing monitoring and adjustment of financial plans. Financial markets and personal circumstances are dynamic and subject to change over time. Therefore, it is crucial to regularly review and update financial plans to ensure they remain relevant and aligned with changing goals and market conditions. This involves assessing the performance of investments, rebalancing portfolios as needed, and making necessary adjustments to account for life events such as marriage, birth, career changes, or unexpected expenses. By staying vigilant and proactive in managing their finances, individuals can navigate the complexities of the financial landscape with confidence and achieve sustained success in finance and wealth management.

Defining Wealth Management

Defining Wealth Management is essential to understanding its significance within the realm of finance and wealth management. At its core, wealth management goes beyond simple investment management; it encompasses a comprehensive and strategic approach to managing all aspects of an individual’s financial life. This includes not only investment planning but also retirement planning, tax optimization, estate planning, risk management, and charitable giving. By taking a holistic view of an individual’s financial situation and goals, wealth management aims to create a customized roadmap that maximizes wealth accumulation, preserves assets, and ensures financial security both now and in the future. In essence, wealth management is about achieving financial well-being and peace of mind through careful planning, prudent decision-making, and proactive management of financial resources.

Furthermore, defining wealth management involves recognizing the importance of personalized and client-centric solutions. Each individual has unique financial circumstances, goals, and risk tolerances that must be taken into account when developing a wealth management strategy. Therefore, a one-size-fits-all approach is insufficient in the realm of finance and wealth management. Instead, wealth management professionals work closely with clients to understand their specific needs and aspirations, crafting tailored solutions that address their concerns and objectives. This client-centric approach ensures that wealth management strategies are aligned with the individual’s values, preferences, and long-term financial goals, ultimately leading to more successful outcomes and greater client satisfaction.

Components of Wealth Management

Understanding the Components of Wealth Management is essential for individuals seeking to achieve comprehensive financial well-being within the realm of finance and wealth management. These components encompass various aspects of an individual’s financial life, each playing a critical role in shaping their overall wealth management strategy. One key component is investment management, which involves selecting and managing investments that align with the individual’s financial goals, risk tolerance, and time horizon. This may include investing in stocks, bonds, mutual funds, real estate, and other asset classes, with the aim of maximizing returns while minimizing risk. Additionally, retirement planning is another crucial component of wealth management, focusing on saving and investing for retirement to ensure financial security in later years. This may involve contributing to retirement accounts such as 401(k)s, IRAs, and pension plans, as well as developing a withdrawal strategy to sustain income throughout retirement.

Risk management is another vital component of wealth management, involving the identification, assessment, and mitigation of potential risks that could impact an individual’s financial security. This may include risks such as market volatility, inflation, longevity, disability, and liability exposure. By implementing risk management strategies such as asset allocation, diversification, insurance coverage, and estate planning, individuals can safeguard their wealth against unforeseen events and mitigate potential losses. Additionally, tax planning is an integral component of wealth management, focusing on minimizing tax liabilities and optimizing tax efficiency in financial decision-making. This may involve strategies such as tax-deferred investments, tax-loss harvesting, charitable giving, and estate planning techniques to maximize after-tax returns and preserve wealth for future generations. By addressing these various components of wealth management, individuals can create a comprehensive and tailored strategy that aligns with their financial goals and priorities, ultimately leading to greater financial security and peace of mind.

Assessing Your Current Financial Situation

Assessing Your Current Financial Situation is a critical first step in the journey towards effective finance and wealth management. Before embarking on any financial planning or investment strategy, individuals must have a clear understanding of their current financial position, including assets, liabilities, income, expenses, and cash flow. This assessment provides the foundation upon which all subsequent financial decisions will be based. By conducting a thorough evaluation of their financial situation, individuals can identify areas of strength and weakness, set realistic financial goals, and develop strategies to achieve them. Additionally, assessing their current financial situation enables individuals to identify any potential risks or obstacles that may hinder their progress towards financial success, allowing them to proactively address these issues and mitigate their impact.

Moreover, assessing your current financial situation provides invaluable insights into your overall financial health and well-being. It allows individuals to track their progress towards their financial goals, monitor changes in their financial situation over time, and make informed decisions about their finances. By regularly assessing their financial situation, individuals can identify opportunities for improvement, implement changes to their financial plan as needed, and stay on track towards achieving their long-term objectives within the realm of finance and wealth management. Ultimately, a thorough assessment of one’s current financial situation lays the groundwork for effective financial planning and wealth management, empowering individuals to take control of their finances and achieve greater financial security and prosperity.

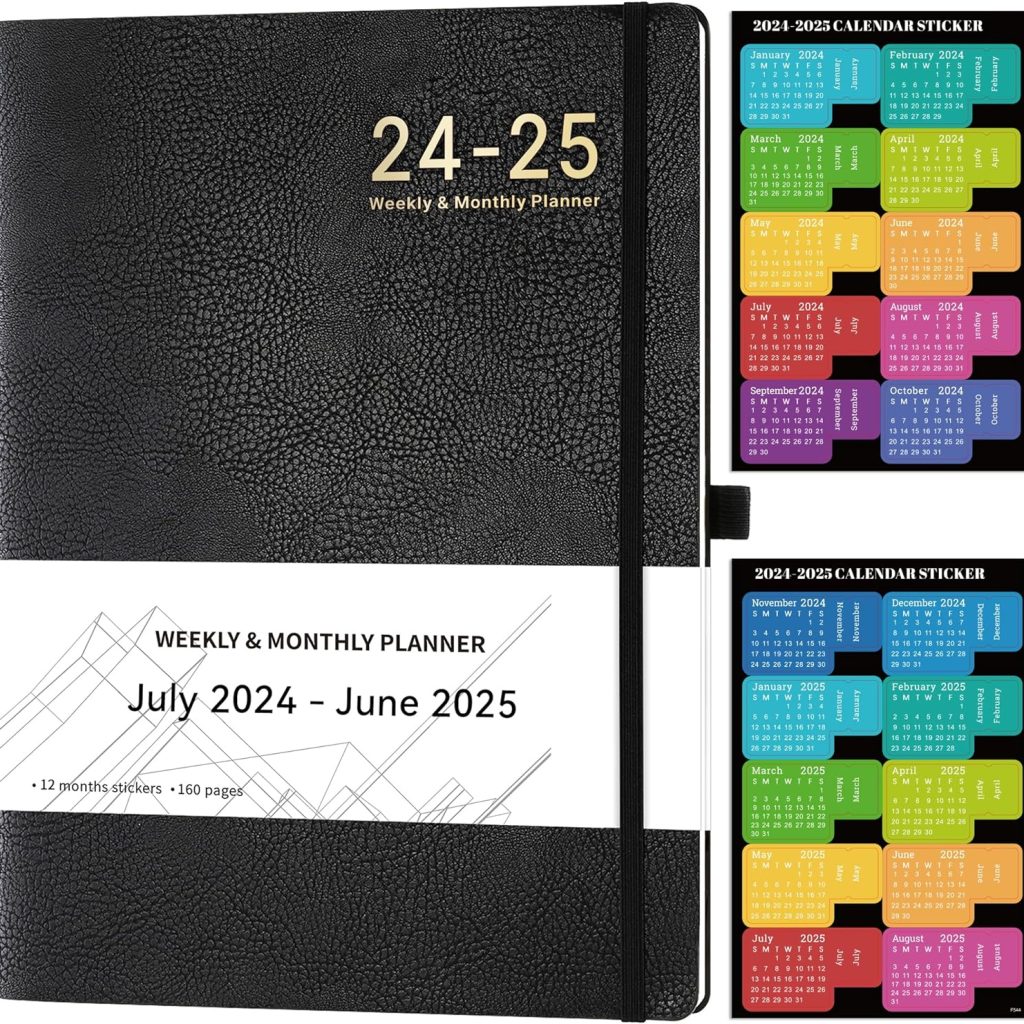

Weekly Monthly Planner 2024-2025, JUL 2024 – JUN 2025, 8.5″ x 11″, Leather Cover Planner 2024-2025 with Thick Paper, Back Pocket with Notes Pages – Black

Investment Strategies

Investment Strategies play a pivotal role in the realm of finance and wealth management, serving as the engine that drives wealth accumulation and growth. These strategies encompass a wide range of approaches and techniques aimed at maximizing returns while managing risk. One fundamental investment strategy is diversification, which involves spreading investments across different asset classes, industries, and geographic regions to reduce the impact of any single investment’s performance on the overall portfolio. By diversifying their investments, individuals can minimize risk and enhance the potential for long-term growth, even in volatile market conditions. Additionally, asset allocation is another key investment strategy, focusing on determining the optimal mix of asset classes based on factors such as risk tolerance, investment goals, and time horizon. By strategically allocating assets, individuals can create a well-balanced portfolio that aligns with their financial objectives and helps them achieve their long-term financial goals within the realm of finance and wealth management.

Furthermore, active versus passive investing represents another important dimension of investment strategies within finance and wealth management. Active investing involves actively buying and selling securities in an attempt to outperform the market, often through research, analysis, and market timing. In contrast, passive investing involves holding a diversified portfolio of securities that closely mirrors a specific market index, such as the S&P 500, with the goal of matching market returns over the long term. Each approach has its own advantages and disadvantages, and the choice between active and passive investing depends on factors such as individual preferences, risk tolerance, and investment objectives. By understanding the differences between these investment strategies, individuals can make informed decisions about how to best allocate their resources and achieve their desired financial outcomes.

Moreover, risk management is a crucial aspect of investment strategies within finance and wealth management. While all investments carry some level of risk, effective risk management involves identifying, assessing, and mitigating potential risks to protect against losses and preserve wealth. This may involve diversifying investments, hedging against specific risks, setting stop-loss orders, and maintaining a long-term perspective. By incorporating risk management strategies into their investment approach, individuals can reduce the likelihood of significant losses and enhance the overall resilience of their investment portfolio, ensuring greater financial security and peace of mind in the face of market uncertainties.

Diversification Techniques

Diversification Techniques represent a cornerstone of effective finance and wealth management, offering a robust strategy for mitigating risk and optimizing investment returns. At its essence, diversification involves spreading investments across a variety of asset classes, industries, and geographic regions to reduce the impact of any single investment’s performance on the overall portfolio. By diversifying their holdings, individuals can minimize the potential for significant losses from any one investment while still capturing opportunities for growth in other areas. This technique allows investors to participate in the potential upside of various market segments while simultaneously protecting against downside risk, making it a fundamental principle in the realm of finance and wealth management.

Moreover, diversification techniques extend beyond simply spreading investments across different asset classes; they also encompass strategies for achieving balance and resilience within a portfolio. For instance, investors may diversify their holdings by investing in assets with different correlation patterns, such as stocks and bonds, which tend to perform differently under varying market conditions. Additionally, they may diversify across sectors and industries to avoid concentration risk, ensuring that their portfolio is not overly exposed to the performance of any single sector. By employing a combination of diversification techniques, individuals can build a well-balanced investment portfolio that is better positioned to weather market volatility and achieve consistent, long-term returns within the realm of finance and wealth management.

Risk Management in Investments

Risk Management in Investments is a crucial aspect of effective finance and wealth management, aiming to identify, assess, and mitigate potential risks that may impact investment performance. Every investment carries a certain level of risk, whether it be market risk, credit risk, liquidity risk, or geopolitical risk. By understanding and managing these risks, investors can protect their capital and preserve wealth over the long term. One common risk management technique is diversification, which involves spreading investments across different asset classes, sectors, and geographic regions to reduce the impact of any single risk factor on the overall portfolio. Additionally, investors may employ hedging strategies, such as options contracts or futures contracts, to protect against downside risk or volatility in specific investments. By incorporating risk management techniques into their investment approach, individuals can enhance the resilience of their portfolio and minimize the potential for significant losses within the realm of finance and wealth management.

Furthermore, risk management in investments involves maintaining a disciplined and prudent approach to portfolio construction and asset allocation. This includes setting clear investment objectives, establishing appropriate risk tolerance levels, and adhering to a well-defined investment strategy. By aligning investment decisions with these parameters, investors can avoid impulsive or emotional reactions to market fluctuations and stay focused on their long-term financial goals. Additionally, regular monitoring and periodic rebalancing of the investment portfolio are essential components of risk management, allowing investors to adjust their asset allocation in response to changing market conditions or personal circumstances. By taking a proactive approach to risk management, individuals can navigate the complexities of the financial markets with confidence and achieve greater financial security and peace of mind within the realm of finance and wealth management.

Building an Investment Portfolio

Building an Investment Portfolio is a fundamental aspect of finance and wealth management, serving as the foundation upon which individuals can grow and preserve their wealth over time. A well-constructed investment portfolio is diversified across various asset classes, such as stocks, bonds, real estate, and alternative investments, to minimize risk and maximize returns. This diversification allows investors to capture opportunities for growth in different market segments while mitigating the impact of volatility or underperformance in any single asset. Additionally, building an investment portfolio involves considering factors such as risk tolerance, investment goals, time horizon, and liquidity needs to tailor the portfolio to the individual’s specific circumstances and objectives within the realm of finance and wealth management.

Moreover, building an investment portfolio requires careful consideration of asset allocation, which involves determining the optimal mix of asset classes based on the individual’s risk tolerance and investment objectives. Asset allocation plays a critical role in portfolio performance, as studies have shown that it accounts for the majority of investment returns over the long term. By allocating assets strategically across different asset classes, investors can achieve a balance between risk and return that aligns with their financial goals and preferences. Additionally, regular monitoring and periodic rebalancing of the investment portfolio are essential components of portfolio management, allowing investors to adjust their asset allocation in response to changing market conditions or personal circumstances. Ultimately, building an investment portfolio is a dynamic and ongoing process that requires careful planning, disciplined execution, and regular review to ensure it remains aligned with the individual’s financial goals and objectives within the realm of finance and wealth management

Conclusion

In conclusion, effective finance and wealth management are indispensable tools for individuals seeking to achieve their financial goals and secure their future prosperity. By understanding the fundamental principles of finance, including budgeting, investing, and risk management, individuals can make informed decisions that align with their long-term objectives. Wealth management provides a comprehensive framework for managing all aspects of an individual’s financial life, from investment planning to retirement planning, tax optimization, estate planning, and beyond. Through careful planning, prudent decision-making, and ongoing monitoring, individuals can navigate the complexities of the financial landscape with confidence and clarity, ultimately realizing their financial aspirations and achieving greater financial security and peace of mind.

Moreover, the journey towards financial success is not static but rather a dynamic and ongoing process that requires continual education, adaptation, and refinement. As individuals progress along their financial journey, they must remain vigilant in assessing their financial situation, setting and revising their goals, and adjusting their strategies as needed. By staying proactive and engaged in their financial affairs, individuals can maximize their opportunities for growth, mitigate risks, and overcome obstacles on the path to financial independence. Ultimately, by harnessing the principles of finance and wealth management, individuals can take control of their financial futures and unlock the full potential of their wealth, ensuring a brighter and more prosperous tomorrow for themselves and their loved ones.

Recap of Key Points

In recapitulating the key points of this discourse on finance and wealth management, it becomes evident that a solid understanding of financial principles is essential for achieving long-term financial success. Throughout this discussion, we have emphasized the importance of financial literacy, setting clear financial goals, and developing sound investment strategies as foundational elements of effective wealth management. Moreover, we have underscored the significance of diversification, risk management, and disciplined portfolio construction in building resilient investment portfolios that can withstand market fluctuations and achieve consistent returns over time within the realm of finance and wealth management.

Furthermore, we have highlighted the holistic nature of wealth management, which encompasses various components such as investment planning, retirement planning, tax optimization, and estate planning. By adopting a comprehensive approach to managing their finances, individuals can create a roadmap for achieving their financial goals and securing their future prosperity. Ultimately, by adhering to these principles and remaining proactive in their financial affairs, individuals can navigate the complexities of the financial landscape with confidence and clarity, ensuring a brighter financial future for themselves and their families within the realm of finance and wealth management.

Final Thoughts on Achieving Financial Success

In wrapping up our exploration of finance and wealth management, it’s imperative to underscore that achieving financial success is not merely about accumulating wealth but rather about cultivating a sense of financial well-being and security. It’s about aligning one’s financial decisions with their life goals, values, and aspirations. While sound financial planning and investment strategies are essential, true financial success also involves finding balance, contentment, and fulfillment in one’s financial journey. Whether it’s saving for retirement, investing for the future, or planning for major life events, individuals must prioritize their financial health and take proactive steps to secure their financial futures within the realm of finance and wealth management.

Furthermore, achieving financial success requires ongoing diligence, adaptability, and resilience. The financial landscape is constantly evolving, presenting both opportunities and challenges along the way. By staying informed, remaining flexible, and being willing to adjust course as needed, individuals can navigate the complexities of finance and wealth management with confidence and clarity. Ultimately, by embracing a holistic approach to managing their finances and staying committed to their long-term goals, individuals can unlock the full potential of their wealth and create a future of financial freedom, stability, and abundance within the realm of finance and wealth management.